how to reduce taxable income for high earners 2020

One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. How Can I Reduce My Taxable Income 2021.

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

A donor-advised fund DAF is an investment account created to support charitable organizations.

. You have to pay for the FSA. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Join an employer-sponsored program that gives you a financial cushion for child care and health care.

Most employers will give you the option of a pre-tax or a Roth 401k. Contribute to a retirement account. For family coverage the limit is 7200.

Maximize contributions to your retirement plan. If you are considered to be a high-income individual and have an adjusted income of more than 150000 per year and a threshold income of more than 110000 per year your annual allowance will be tapered. How to Reduce Taxable Income.

Take precautions so that you arent d credit. One of the easiest ways to begin slashing your annual income tax bill is by contributing to a retirement account. 401k and 403b helps in that every dollar you put in is not taxed until you take it out.

An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA. Bonuses that are more lucrative. Use a Flexible Spending Account FSA.

Here are five tax saving tips that are easy to apply. Consider the credit for contributions to retirement savings which is the child tax credit. One of best ways for high earners to save on taxes is to establish and fund retirement accounts.

High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. For example in 2020 we plan to deduct all of the following from our taxable income. Make changes to W-4 withholding.

Investing in these types of accounts ie. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. According to the IRS high-income earners pay almost 70 of the total federal income tax they collect.

For family coverage the limit is 7300. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post. 6 Tax Strategies for High Net Worth Individuals 1.

For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower. Claim all the tax deductions you can. Max your pre-tax 401k.

Donate money goods or stock to charity. For individual coverage the limit is 3650. If youre 55 or older you have the option of adding an extra 1000 to your contributions.

Sell short at the highest price. For individual coverage the limit is 3600. If you are self-employed read more tax hacks here.

A Roth retirement account has its own benefits but it wont reduce your income this year. 5 Tax Strategies For High Income Earners 1 Invest in retirement accounts. What Are 3 Ways You Can Lower Your Taxable Income.

Make a donation to charity Ensure your retirement is as healthy as possible. This can potentially result in a high tax liability for high-income earners. To reduce your reportable income you should start with maxing out your pre-tax 401k.

Make deductions faster and defer income. 50 Best Ways to Reduce Taxes for High Income Earners. Reduce your taxable income in 2020.

The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill. In most cases the taxes you pay directly relate to how much you earn. These contributions allow you to reduce your annual.

The contribution you will make will come straight out of your. How to Reduce Taxable Income for High-Income Earners in 2021 Max Out Your 401 k Have a Plan for Your Non-Retirement Account Assets Bunching Donor Advised Funds DAF Contribute to Your HSA. With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Claim all the tax credits you can. For 201920 the annual pension contribution limit for tax relief purposes is 100 of your salary or 40000 whichever is lower.

If your work or assets generate significant income you could pay up to half of your earnings to the US. There are many strategies to help you maximize your charitable contributions and reduce your income tax. Federal tax rules allow certain deductions that.

Invest in retirement plans and contribute substantially. A maximum contribution of 2880 a year is topped up to 3600 thanks to tax relief. Fortunately there are many ways high earners can reduce the taxes on their income.

How to reduce taxable income for high earners through your employer benefits. July 24 2020 225242. You can deduct the amount you contribute to a tax-qualified retirement account from your income taxes except.

How To Reduce Taxable Income In 2021 Youtube

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Is Taxable Income Calculated

5 Smart Ways On How To Reduce Taxable Income For High Earners

How Do 401 K Tax Deductions Work

Personal Income Tax Brackets Ontario 2020 Md Tax

How Do Marginal Income Tax Rates Work And What If We Increased Them

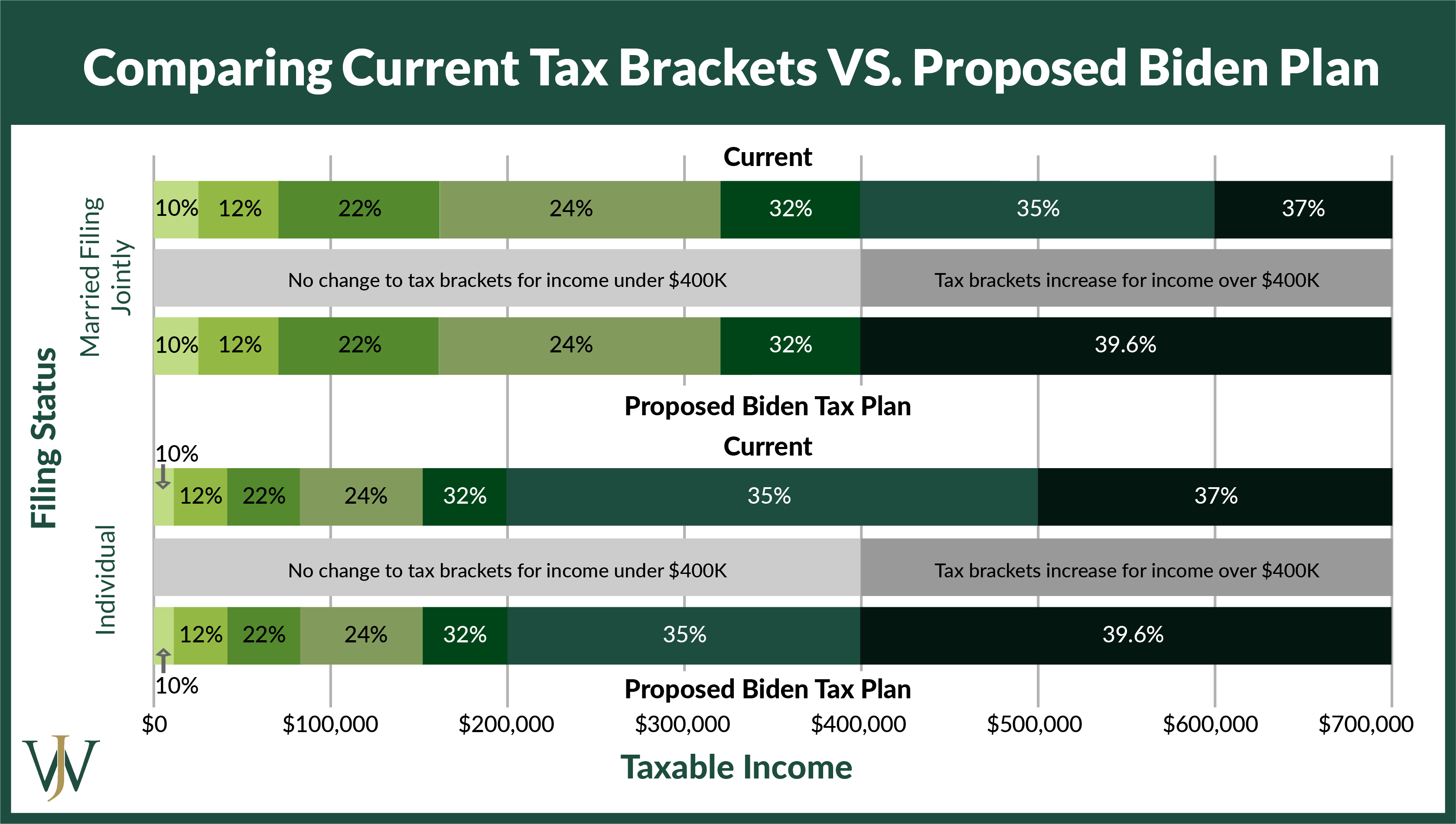

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

The 4 Tax Strategies For High Income Earners You Should Bookmark

6 Strategies To Reduce Taxable Income For High Earners

Tax Strategies For High Income Earners Wiser Wealth Management

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is Taxable Income And How To Calculate It Forbes Advisor

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)